Investing for retirement in a recession

I've

been putting a lot of thought lately into how we invest the fruits of

our labors. A decade ago, I read a basic investment book that

told me to put 10% of my income in a mutual fund for retirement, and

I've been following along like a sheep ever since.

I've

been putting a lot of thought lately into how we invest the fruits of

our labors. A decade ago, I read a basic investment book that

told me to put 10% of my income in a mutual fund for retirement, and

I've been following along like a sheep ever since.

But investing in a

combination of stocks and bonds means that I believe in a growth economy. Do I? I

certainly don't believe a growth economy is good, and I'm not so sure

that I believe our economy will grow over the next forty years.

On the other hand, I

don't really believe in apocalyptic scenarios either, so I don't plan

to invest in gold. (As Mark pointed out, coins worth over a

thousand dollars apiece are unlikely to be terribly useful in an

apocalyptic scenario anyway.) I'm guessing social security will

be around when I retire, but may only pay out half of what my

statements tell me to expect. Perhaps our best bet is to put our

dribs and drabs of retirement money in some combination of ultra-safe

investments (like CDs) and into farm infrastructure to make our annual

operating costs lower.

I'm curious to hear our

readers' take on investment in today's climate. Do you stick to

the rosy view that the economy will rebound, meaning that social

security will fulfill most of your needs and you'll round out your

retirement income with some sort of mutual fund? Or do you think

society as we know it will collapse and social security will be

completely absent, so you'd better stock up on firearms? I'm most

curious to hear from folks who think the future will be somewhere in

the middle --- how do you invest for your old age?

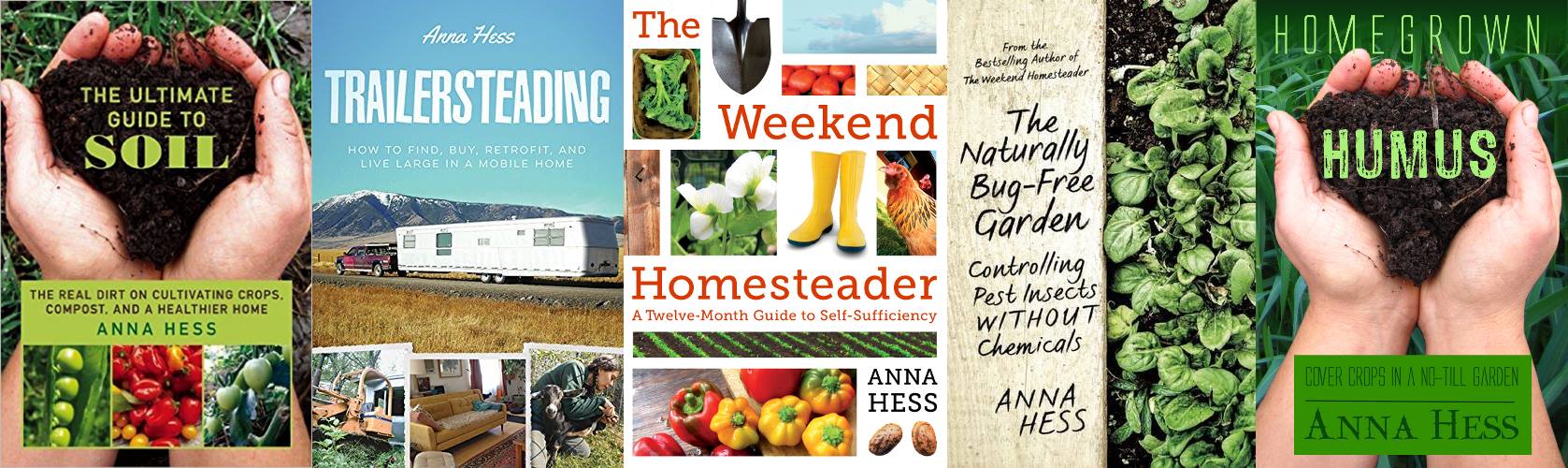

Want more in-depth information? Browse through our books.

Or explore more posts by date or by subject.

About us: Anna Hess and Mark Hamilton spent over a decade living self-sufficiently in the mountains of Virginia before moving north to start over from scratch in the foothills of Ohio. They've experimented with permaculture, no-till gardening, trailersteading, home-based microbusinesses and much more, writing about their adventures in both blogs and books.

Want to be notified when new comments are posted on this page? Click on the RSS button after you add a comment to subscribe to the comment feed, or simply check the box beside "email replies to me" while writing your comment.

Bobb --- I was hoping I wasn't the only one putting thought into this now. It sounds like you're hedging your bets by investing in probably stocks and bonds with your 401K, your property (which we don't consider an investment since I'd never sell it --- I plan to die here), and some safer investments like CDs and gold. Diversification does make a lot of sense to me too. If you check back, I'd be curious to hear how you're also planning for the worst-case Armageddon scenario.

Daddy --- The problem with land as an investment is that you have to sell it to get your money back. (Or rent it, but that opens a whole new kettle of fish.) I get so attached to land that the notion of selling it is tantamount to selling Huckleberry --- unimaginable!

Lisa --- You've got a very good point about energy costs going up. So even though paying for electricity only makes up perhaps 5% of our annual operating cost at this point, we probably should plan for it to make up a larger percentage in the long run, unless we become more efficient. That would definitely be a good area to sink farm-upgrade-money.

I'm curious to see you investing in money market funds --- I thought they mostly crashed a year or two ago? I had our three month emergency buffer in one and was very lucky that the company I was using saw the trouble coming and rolled our accounts over into high interest savings accounts, so we lost nothing.

My thoughts about social security are as follows --- if it exists when we retire, we're sitting pretty since we already live so simply that social security would meet just about all of our needs. So I might as well ignore that option and plan for the scenario where it doesn't exist.

Anna, Great discussion here. So I live in a condo in an old mill town. I've been tied to a cubicle since I graduated college a decade ago. But we had a baby 18 months ago and have decided to change our lives in extreme ways. We're just at the start of that process. So while we're making radical changes for the health of our family (eating only organic and local food), I think it will all benefit us if Armageddon does come, and some scientists think it will: http://www.dailymail.co.uk/sciencetech/article-1287643/Human-race-extinct-100-years-population-explosion.html

So I'm leaving my management level job this week to become a stay at home dad and homemaker - and we'll be very tight on money. Our parents' generation didn't teach me or any of my friends anything about self reliance. So we're teaching ourselves. I'm on Year Three of my container garden, learning the very basics of agriculture; my compost bin is the most successful element so far

But we hope to move further to the country to a modest plot of land fit for cultivating and closer to family - which is good for lifestyle purposes but also for Armageddon purposes. Just started a book called The Backyard Homestead and finished No Impact Man. Daydreaming about things like root cellars and learning about things like cold frames from folks like you. Taking a few canning classes to learn to preserve the local food we buy and grow for the winter; we're freezing it all now. Applied at a local farm for part-time work to learn more. We're learning to make our own soap, shampoo, that kind of stuff. Cloth diapers; Freecycle; unplugging the TV. No more paper napkins/tissues etc. It's really retraining the brain to be happy without modern conveniences - because they really don't make us happy after all. I bet you guys are doing much the same.

A friend and I debate if we should get guns for Armageddon. I hate the idea, but maybe one day I'll bury a shotgun in the backyard just in case; they'll come for gold and corn alike. I recommend checking out the documentary Collapse - it's all about this kind of stuff. It says having a good cache of organic seeds will be key, for eating and trading. And these Norwegian folks have the same idea: http://en.wikipedia.org/wiki/Svalbard_Global_Seed_Vault

And I love the idea of growing old and dying on one's land. We should all aim for that end!

-Bobb

Bobb --- it sounds like you're on the right track! I've discovered that it's a lot harder to give up modern conveniences than to never accept them in your life at all, so I'm always been pretty vigilant about not letting them seep in. Of course, I was lucky to be raised by parents who believed in living simply, so I started off on the right foot.

I think you'll discover that you don't really need much money. If you haven't already read it, you should check Your Money or Your Life out of your local library --- it gives some great advice for getting back to basics.

We are on the gun side, but only because deer hit our garden bad and we want to be able to turn them into dinner. As I become more of a farmer, having a gun for hunting seems to be an important part of homesteading.

As I become more of a farmer, having a gun for hunting seems to be an important part of homesteading.

Anna / Mark, I think you're well ahead of many people in that your place is almost/pretty much paid for. My retirement fund right now consists of 401K, social security and paying off this land and house as soon as humanly possible. We are adding a deck out back so we can have some privacy in the morning away from the road and enjoy our little spring branch, but after that there are going to be NO major improvements, no other investments, no purchases... every single dime we save is going to be put into paying the place off.

When you think about the cost of a mortgage over time, even a low 5% interest rate adds up to some serious money. You end up paying three or four times as much as you "purchased" the place for. I don't know many investments out there that return 200%-300% over 15-30 years guaranteed. I'm not talking about property value either. I'm just talking about saving money by not having a mortgage. And you're already pretty much there!

Aside from that, I also agree with the land investment thing. They really aren't making any more of it. I know you grow attached to land, but think of it this way: If you could manage to save up enough to by another 30 acres somewhere else in the county, you would have the ability to sell that when it comes time to retire and make sure good people who want to settle there buy it instead of some shady investor who wants to put up a sub-division of 2-acre summer homes for people who live in Florida the rest of the year. Or worse (strip mining, mountain top removal, etc...)

Another investment I've been thinking about is buying my mom's house. She could live there rent/mortgage free for the rest of her life and about the time we're ready to retire she will probably have passed on. We would then sell the place. Providing we don't go into total economic and societal collapse, real estate values do not go down over a 30-year period. Just think about how little a house and some land cost when you were born!

But first thing's first: Pay this place off. You have the right idea in that the best possible investment you can make is to minimize your expenses. Buy the farm (literally), invest in long-term infrastructure, possibly some renewable energy, and hope zombies don't attack.

Everett --- Thanks for that thoughtful and thought-provoking comment! I really like your idea of buying your mother's house, since I think that no one can really plan for retirement without considering how their nuclear family and closest friends are doing. Realistically, none of us are going to let our mothers get tossed out on the street and starve, so it's worth planning how we're going to care for elderly parents (especially if they don't have much cash) while we think about our own retirement.

If you're like us and like lots of personal space, that may mean buying parents without their own safety net an accessible house closeby. That probably should be on our plan, actually, since my mom is single and doesn't have a lot of savings. It's a lot easier to keep someone fed on garden produce if you don't have to drive an hour and a half to bring it to her....

I think that you're on the right track to get that mortgage behind you ASAP. Plus, you have plans to make your farmstay a reality, which could be a great retirement income that might not need much work from you after the initial building. Having a steady stream of relatively passive income from an on-farm industry is probably the best way to ensure you'll do well in retirement!