How to sell an ugly duckling property

If you've read Trailersteading, you'll know what I mean

when I say that our Virginia homestead is an ugly duckling property.

This type of unique real estate is often economical to purchase, can be

wonderful to live on...but isn't particularly easy to sell.

We've tried out three

different methods of finding our farm a new owner and have opinions on

each. If you're selling a similar property, perhaps our ideas will help!

Option

1: Sell it to your neighbors. They say that the number one

rule of real estate is location, location, location. Which means your

neighbors --- who've already put down roots right there --- are an

obvious audience to sell to. We actually had some interest from one of

our neighbors (plus a low-ball offer from a local timber baron), but

ended up running through this avenue pretty quickly. It's still worth a

try, though!

Option

2: Go traditional with a realtor. With a conventional

property, I suspect this is the way to go. Ugly duckling properties,

however, are often hard to finance through a bank and mainstream

realtors don't really know what to do with them. Plus, realtors take a

hefty percentage, so the price has to remain high.

If I had to do it over again, I might have moved this option further

down the list and waited until we gave up on selling the property on

our lonesome. On the plus side, most realtor contracts are

time-limited, so if it's not working you can just wait until the

contract expires.

Option

3: Go unconventional with owner financing. This seems to be the more

realistic option since you're likely to be attracting most potential

buyers yourself if your property doesn't fit the conventional mold.

We're currently giving this option a try and may have found someone

just crazy enough enjoy our floodplain.

No money has yet changed hands, however. So you can still peek

at our listing if

you want to throw your hat into the ring.

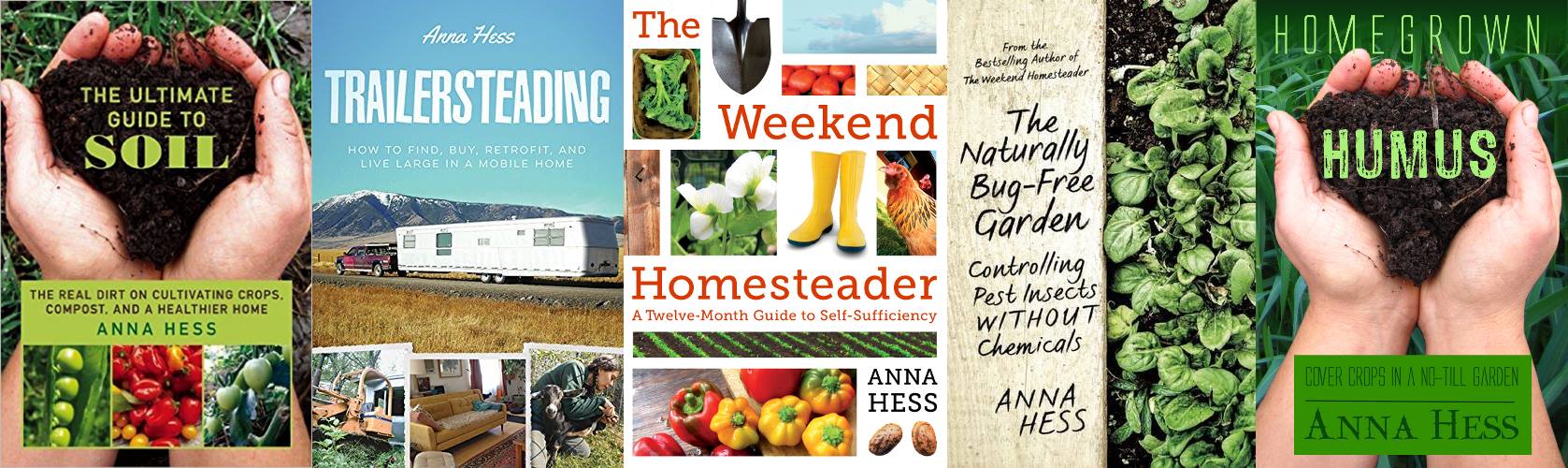

Want more in-depth information? Browse through our books.

Or explore more posts by date or by subject.

About us: Anna Hess and Mark Hamilton spent over a decade living self-sufficiently in the mountains of Virginia before moving north to start over from scratch in the foothills of Ohio. They've experimented with permaculture, no-till gardening, trailersteading, home-based microbusinesses and much more, writing about their adventures in both blogs and books.

Want to be notified when new comments are posted on this page? Click on the RSS button after you add a comment to subscribe to the comment feed, or simply check the box beside "email replies to me" while writing your comment.

I found out myself how hard it is to finance anything with a mobile or manufactured home on it twenty plus years ago- found a place with five acres and you could not tell it was a 16x80 from the road. There had been a gabled roof over done, a large porch added on with a nice potbellied wood stove. The owners grew vegetables for the farmer's market, it was mostly flat (as is anything in the coastal plain) with a small dug pond.

An hour west of Savannah GA and it was 42 thousand. But it may as well have been a million, I had to have 25 percent down because the bank valued the home at about zero. Basically, I was just buying land that happened to have a dwelling on it.

A month later,I was able to buy a conventional home built in the 1950's on a 1/3 acre lot with a big detached garage/workshop for $68,000 and $2% down. Here I still am, managed not to lose it in a divorce in 1998- but this place will be hard to sell when we move on too.

Though it meets our needs and is a solid (nearly paid for!) place, it is on a four lane highway and zoned commercial/residential. It is right next door to a large church, whom we will let make the first offer.

We sold our home a year ago and had someone ask early on if we would consider seller financing. After a long discussion my husband and I decided that we weren't comfortable with the risk.

All of our concerns stemmed from what would happen if the buyer stopped paying: Would we be able to deal with the guilt of enforcing the loan terms if they came to us with a sad situation, were we willing to deal with the headache of evicting them and fixing up the property again to put it back on the market, and then the time for it to sell and having to hope for a timely buyer again. The first issue was especially troubling to us since we have each been taken advantage of in the past by having our desire to help others preyed upon.

It ended up taking about a year to sell our house, but even with the cost of making the payments and maintaining it while it sat empty I still think we made the right decision. I have a hard time saying no, and I don't know if I would have been able to put my foot down and enforce the contract if the buyer had a terrible situation and couldn't pay and asked for leniency, and at least for us it was worth waiting to be able to sell outright and let collecting payments be the bank's problem.

Hi Anna and Mark,

I too had an 'extra' house. I recently got lucky. A person I knew was very interested. He helped with moving my stuff out. My lawyer, his title company. Just cashed his check :).

God was taking care of me.

For me it was about patience.

I hope your patience pays off also.

I hope you too can get a 'clean' deal.

John