Estate taxes as a barrier to small family farms

The most interesting part of

this week's selection in Folks,

This Ain't Normal was Salatin's chapter on inheritance taxes.

I'm surprised he didn't add property taxes to the list of money-related

regulations that make it tough for family farmers to keep the land in

agriculture, so I'm going to pretend he did and discuss both issues

today.

The most interesting part of

this week's selection in Folks,

This Ain't Normal was Salatin's chapter on inheritance taxes.

I'm surprised he didn't add property taxes to the list of money-related

regulations that make it tough for family farmers to keep the land in

agriculture, so I'm going to pretend he did and discuss both issues

today.

Salatin tells us that

his farm, bought by his parents in 1961 for $49,000, is now worth $1.5

million. Although a quick search of the internet suggests there

might be exemptions that would keep him from paying that tax, Salatin

posits that if he wants to keep farming the land after his parents die,

he needs to be prepared to pay $525,000 in inheritance taxes. He

does mention that there are workarounds to inheritance taxes if you get

the ball rolling early enough, but it is worth considering the

worst-case scenario, which often forces the offspring of deceased

farmers to sell the land to developers.

Similarly, I've read on

others' blogs of their astoundingly high property

taxes, often several thousand dollars per year, which make true

on-farm self-sufficiency impossible. For those of you looking for

land, I think it's worth keeping property taxes low by looking for an

ugly duckling property (as I explain in Trailersteading)

and by avoiding thinking of your dwelling as an investment that should

be increasing in value. But you clearly don't have those choices

if you're lucky enough to inherit a family farm.

Salatin is a libertarian, so he'd say the

solution to these problems is deleting taxes, but I think the issue is

deeper and has to do with ever-rising land prices. For example, in Salatin's

previous chapter, extensive quotes by Benjamin Franklin about the

differences between the young United States and Europe included this

gem:

Salatin is a libertarian, so he'd say the

solution to these problems is deleting taxes, but I think the issue is

deeper and has to do with ever-rising land prices. For example, in Salatin's

previous chapter, extensive quotes by Benjamin Franklin about the

differences between the young United States and Europe included this

gem:

Franklin goes on to explain that the early United States didn't have big manufacturing businesses because of "labor being generally too dear there, and hands difficult to be kept together, every one desiring to be a master, and the cheapness of land inclining many to leave trades for agriculture." In other words, cheap land made people want to farm rather than working for a boss, and I suspect the same would be true today. If Salatin wants lots of small family farmers back on the land, it seems the obvious issue to pursue is lowering land prices.

What makes land prices rise? I'm inclined to say the larger the population and the higher our standard of living, the more expensive the land, but I'm neither an economist nor a historian. What do you think about inheritance and property taxes (plus zoning and the other issues brought forth in this week's reading)? Is there a way to make it feasible for interested young people to find land to farm and for children to take over their parents' estates with ease?

We'll finish up Folks, This Ain't Normal next Wednesday. Meanwhile, you can read other Salatin-based musings in part 1, part 2, part 3, and part 4 of the book club discussion. Thanks for reading along!

Want more in-depth information? Browse through our books.

Or explore more posts by date or by subject.

About us: Anna Hess and Mark Hamilton spent over a decade living self-sufficiently in the mountains of Virginia before moving north to start over from scratch in the foothills of Ohio. They've experimented with permaculture, no-till gardening, trailersteading, home-based microbusinesses and much more, writing about their adventures in both blogs and books.

Want to be notified when new comments are posted on this page? Click on the RSS button after you add a comment to subscribe to the comment feed, or simply check the box beside "email replies to me" while writing your comment.

I am going to post my 2 cents worth, and will admit that I have not read this book yet, but am a CPA so know a bit about the estate taxes. The current Federal estate tax exemption is $5 million or $10 if you are married, which should be large enought to pass on most small farms. Even if you assume $5,000 per acre, which is a lot, that is a 1,000 acres or 2,000 if you are married. And I, or any CPA with estate planning experience, will have a few additonal ways to get even more than that transitioned for a reasonable fee, probably 1/10 or 1/100 of the money you would save in taxes.

As a person looking to one day move back to the land, cheaper land with low property taxes is important to me. I think that the quotes point out another principle, if you want cheaper land you need to move farther from the rest of civilization. Not to say you have to be out on your own, but you do need to be at least 1-3 hours from any medium sized city and 4-6 hours from any large city to find really cost effective land. Or at least that is what I have seen when I have looked in the midwest.

I look forward to having more time to read this and the other books from Joel as I have time. Thanks for all you do Anna & Mark.

Hi Anna and all, I really enjoy reading the thoughts here. I grew up having it drilled into my head that the corrupt government was to blame for all of man's problems. They say: "Remove/limit the government and all will be well." I bought into that for a long time. With a government that is "of, by and for the people" how can the two be treated as two totally separate entities? Aren't we are all very much a part of the wheels of this "thing"? I agree with you that inflation is a barrier. I go to the grocery store and observe how packages get smaller and prices go up. To this my supposedly conservative acquaintances rail against government regulations, saying the poor company is forced to do this. What a crock of bull. I think we have to look at what practices we ourselves are doing to contribute to the problem, which leads to my main thought... even if we fix the economic issue we have a much larger problem: a lack of interest or desire. Giving away land for free won't fix this problem. It's crazy to consider that without children (our most important seed) who will work the land? who will carry on what we have begun? We push them into the industrial model where they are herded like animals. They are raised under the most unnatural conditions. They have their greed fed at every turn. Then we wonder why in the world they run from farm life. They look at the homestead and know that there is not likely to be great wealth amassed with this lifestyle. We have to raise/feed them much differently. Salatin does treat this issue in his writing to a large degree, but I think it deserves the most attention---far more than the economic/government stuff. If there is zero interest what difference does any other change make at all? I'm a Christian as Salatin is, but I personally believe that efforts made to reform man that aren't spiritual (through Jesus Christ) are vain at best and destructive at worst. Until then, we are just treating the symptoms of a much deeper disease. We (Christians) have to be careful what message we send.

A couple of facts: 98% of American farms are family owned. Half of all American famrers are more thn 60 yrs old, ie- over the next 25 yrs, we can expect at least half of all farmers will die.

The real goal of the Draconian inheritance tax is to put most ag acres into the control of only a handful of large corporations. As older farmers die off, the families inheriting the land will be land rich, cash poor and be forced to sell out to cover the tax burden. The only ones with large amounts of cash to buy the farms: a few large corporations. It is easy to control a few large corps, as opposed to many small operators.

This is exactly the goal of the Dodd-Franks banking laws: they will put all small, local banks out of business over he next few yrs. Four or five large banks will be easier to control than many small banks.

It's all about control. The goal of this govt is to make us all dependent on the govt. BO learned his politics in Chicago where everyone's livliehood depends on patronage. His modus operandi is obvious.

Isn't it ironic that The Party that so champions "diversity" governs by forcing all people to obey the "one size fits all" mandates?

Like Brian Ring pointed out, the estate tax exemption should be more than the value of the $1.5 million farm, unless there are a lot of other assets not mentioned. There may be places where a small farm might be valued at more than $5 million, but I suspect the majority are not. In this area of the country, one can easily buy 500 acres with a house and multiple barns for less than $1 million, and I'd guess that most people would consider 500 acres to be, at the minimum, on the upper limit of what would be expected of small family farm.

Like you, I think that the major issue is with rising real estate prices. I see two causes for this. The first is that we've been taught to treat land as an investment, rather than a home. The second is that the availability of relatively low cost loans has made it possible for more people to afford land, which has in turn drive up prices. If Salatin's family farm had appreciated at the rate of inflation, it would be worth approximately $365,000 instead of $1,500,000, which would result in significantly lower property taxes.

Hi All,

Besides Sepp Holzer's "The rebel farmer", the above website in pretty impressive.

He has a phrase in there about city folk wanting to live comfortably without working very hard. Or as Joe Salatin puts it: One government office leads to another.......

But to my mind and much more important like Sepp, Mr. Palekar shows how he does it!!

IMHO VERY IMPRESSIVE. Check it out!! Start farming that way. Look at his list of farms already copying his method!

John

A quick search shows that while there was a 5M exemption in 2012, in 2013 it drops to 1M. This comes from http://www.faireconomy.org/news/estate_tax_faqs . This appears to have been written 3 or 4 years ago, so I would hot bet the farm on the 2013 exemtion.

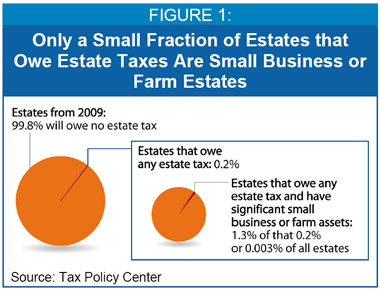

Also "The estate tax is reserved only for society's wealthiest elite. In 2009, just one-quarter of one percent (0.25 percent) of all estates were expected to owe any estate tax at all."

And "On average, those few small business and farm estates will owe only 14 percent of the estate, so it is unlikely they will have to sell the business or farm. Plus, they can spread any payments over 14 years. They also benefit from special use valuation, and minority interests and marketability discounts."

The message posted by Doc states "This is exactly the goal of the Dodd-Franks banking laws: they will put all small, local banks out of business over he next few yrs. Four or five large banks will be easier to control than many small banks.

It's all about control. The goal of this govt is to make us all dependent on the govt. BO learned his politics in Chicago where everyone's livelihood depends on patronage. His modus operandi is obvious."

This is such foolishness. The Estate tax laws have nothing to do with the current administration. The interpretitation of the affects of Dodd-Frank are as paranoid as they are wrong. Why BO for Obama? Spare me.

The argument that 'THEY' are coming to take us away is a shallow argument.

If tax code negatively impacts homesteaders, then outreach and education is needed to reform the law. If a business, even a farming enterprise, has evolved into a multimillion venture, then it has entered into a domain that "family farm" is not the only descriptor. How has tax law and agricultural laws allowed it to expand?

The estate tax was set to lower to 1 million, but the last miniute tax bill extended the 5 million limit. So as far as estate taxes and income taxes I don't think that small farms have it too bad, but for property taxes and regulations it is horrible!

As far as you not thinking the government is not trying to control us, of course they are! When they tell me I can't drink raw milk or that I can't sell my deer meat to a friend that is controling me! I have too many more examples to list here.

You live in a society governed by rules [laws] not in an anarchy and not in lawless frontier. These boundaries that restrict, or enable, your personal conduct are not create by an evil “THEY”, the government. We live in a democratic republic and we vote for those who create these rules.

This is not a political forum, so I feel compelled not to engage the silly speak that has overwhelmed common sense.

Everybody --- I just wanted to chime in and say how much I've enjoyed reading everyone's well-thought-out opinions. Despite Gerry's latest comment, I don't think any of you have been out of line and I appreciate you keeping the flaming down even when you disagree with each other. Thanks for sharing your opinions and input!

(P.S. --- We'll be discussing government control of food next week, so you'll have plenty of time to talk about raw milk then. )

)

The new inheritance tax law will apply to estates over $5M. If land is $5000/ac (IA cropland is now going for $20,000/ac) then a 1000 ac farm is affected by the new law. Add in $400,000 in equipment & buildings and now a 920 ac farm qualifies. If profit from farming is only $100/ac (and that might be unrealistically hi), then a 1000 ac operation would yield $100,000/yr income. Given the risks, not to mention the work involved, any farmer with less than 1000ac is probably not in it professionally, but more as a hobby/life-style choice. He has a town job, too.

To Gerry: the money to be realized from this law is a drop in the ocean comapared the natl debt & deficit..So, what exactly is it's purpose? Could it be control? QED.

This isn't likely to be a popular comment, but I'll make it anyway

If I won $4 million from the lottery, it would be considered income and I would fully expect to pay income tax on it.

If my parents had $4 million in cash sitting around, and left it to me when they passed away, I'd consider it income, and would fully expect to pay income tax. Why wouldn't I? The source of the money is irrelevant (maybe not as far as tax law is concerned, but in real life), its still $4 million I didn't have before.

If, instead, my parents owned a farm worth $4 million and left it to me when they passed away, this would not be considered income and would be exempt from the estate tax. The only difference, though, is that now instead of having $4 million in cash, I have a $4 million farm. Either way, I have assets of $4 million that I didn't have before, but with the farm I didn't have to pay the same taxes.

Personally, I don't see why I shouldn't be expected to pay taxes on the farm. In my view, income is income, whether its cash, stock, real estate, or a physical asset.

The law is, I believe, at the top 0.001% of the population. This would be individuals who have net worth much higher than any farmer. Folks like Warren Buffet, Bill Gates, Michael Bloomberg, and David H. Koch and Charles G. Koch would be the targets, and the idea, imo, is that their kids should not be quite so lucky just to have won the genetic lotery.

This is not recent law, and not a product of recent politics. I tried to point out that if this law unfairly impacts farms, especially because of the cost of land, adjustments to the laws should be made.

IMNHO, I'd be glad to endorse a waiver of all such estate taxes in lieu of the descendants rights to convert the use of the land to non-farming activities. Farm land needs to remain farms not condo projects.

I tried to find information about thee size of family farms, but could find information about the gross income instead. Very large family farms are defined as having more that $500,000 per year in income, and they were the only type of family farm that had more income than expense. [That btw is an injustice!] Here is the link to the PDF. http://www.ers.usda.gov/media/823423/aib769_1_.pdf

It should be noted that the lowest level farm had an income of $100,000, so that does not say anything about homesteaders.

QED? Hardly. The purpose of any tax is multifaceted. Control of the individual is not on that list, imo.

I would suggest that there are at least two main reasons: To pay the bills and to redistribute wealth within the society. Please let's not talk about our bills, not here. But if you want to reflect on why redistribution is a reasonable goal look at the tax foundation’s data. http://taxfoundation.org/sites/taxfoundation.org/files/docs/ff285.pdf

The top1% of income earners in 2009 earned 125% of the total of all wages of 50% of all workers. As is, this is not a just distribution of the wealth of this country. The working poor, who labor to crate this wealth, should receive a more equitable share.

If the purpose of banking-related taxes is to increase goverment control over banks, then your proposed method of driving small banks out of business so there will be only a few large ones, is exactly the opposite of the what the govt should be doing.

A multitude of small institutions will never have the bargaining power to argue against a large institution such as the US federal goverment. It's easy for a few large organizations to coordinate and fight back against the government. In fact what tends to happen when there are a few large institutions is "regulatory capture" - wherein those who are supposed to be regulated, in effect take over the regulator and have it create regulations that benefit the regulated. As an example think about the Department of Agriculture, agribusiness, and the meat business.

Gerry, what country has ever succeeded in the long term where they had a a redistributive (socialist) policy? If you take away ones incentive to work hard to earn money then who is actually going to work and complete anything? What was the car that Russia tried to produce during the peak of the old USSR? I forget what its called ... all the workers were guaranteed a job. Look at the results of the cars that came off the line .

Every American has the same opportunity to succeed if they will but apply themselves and work hard towards their goal. THAT is the American dream and the reason that so many millions of people have immigrated to the US.

If you're supportive of the socialist scheme of redistribution that's fine. Give up a large portion of your income VOLUNTARILY to a less fortunate family or individual. But please stop trying to take from me and my family. I've earned it, I decide where and how it is spent.

My children are still young, and I've not amassed anywhere close to the 4 million dollar amount you mentioned. But here is my take on the matter. I pay my taxes and take care of my family. After my taxes are paid I try and stick some of whatever money is left away for a rainy day. It's my money and it's already been taxed. The government no longer has any right to it.

50 years from now, regardless of the reason, if that money goes to my kids the government shouldn't be able to touch it. Why do they get to tax money twice?? If they want to tax that money when it's spent, fine.