Discover cards give cash back

I heartily believe that about 85% of Americans

shouldn't have credit cards. If you've ever paid a fee on your

credit card, it's costing you money. If you've ever used a credit

card to pay for an "emergency expense" you should cut it up now.

If you don't obsessively comb over your credit card bill every month to

check every charge, dispute any problem, then pay your bill in full,

you might as well stick with cash. Of course, if you mind having

all of your intimate purchasing details in the hands of a big company,

you should skip this tip too.

I heartily believe that about 85% of Americans

shouldn't have credit cards. If you've ever paid a fee on your

credit card, it's costing you money. If you've ever used a credit

card to pay for an "emergency expense" you should cut it up now.

If you don't obsessively comb over your credit card bill every month to

check every charge, dispute any problem, then pay your bill in full,

you might as well stick with cash. Of course, if you mind having

all of your intimate purchasing details in the hands of a big company,

you should skip this tip too.

But, for the other 15% of you, sign up for a Discover card and start

raking in the cash. Discover has a cashback program which gives

you 1% to 5% of your purchases back as just plain cash. Don't

fall for their affiliate program where you can turn your cashback into

purchases at your favorite stores --- those are impulse buys and you

don't need that stuff.

To make a Discover card work for you, I believe you should have 3 to 6

months of emergency money stashed away in a savings account.

That's the money you spend if something drastic and terrible happens,

rather than pulling out your Discover card.

That said, use your Discover card for every other possible purchase. We keep our expenses

very low, but still end up getting nearly $200 of free money every year.

If you're keeping track at home, that's an infinite return on our

investment since we didn't spend any extra money to get it.

| This post is part of our Frugal Living Tips lunchtime series.

Read all of the entries: |

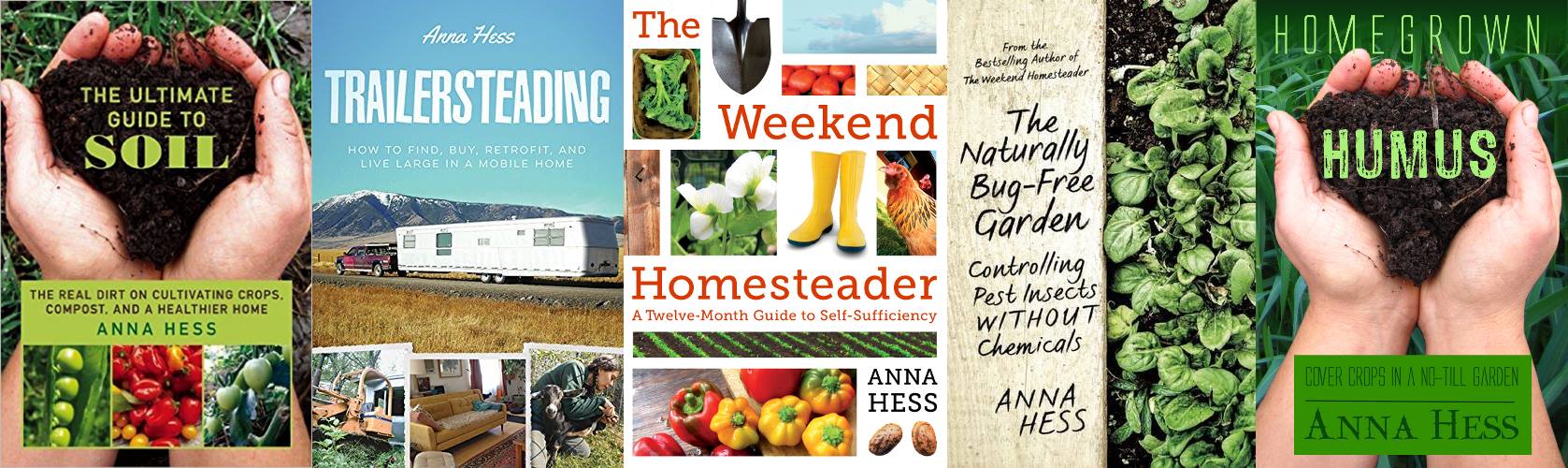

Want more in-depth information? Browse through our books.

Or explore more posts by date or by subject.

About us: Anna Hess and Mark Hamilton spent over a decade living self-sufficiently in the mountains of Virginia before moving north to start over from scratch in the foothills of Ohio. They've experimented with permaculture, no-till gardening, trailersteading, home-based microbusinesses and much more, writing about their adventures in both blogs and books.

Want to be notified when new comments are posted on this page? Click on the RSS button after you add a comment to subscribe to the comment feed, or simply check the box beside "email replies to me" while writing your comment.