What is your real hourly wage?

Did you know that your job

may be costing you money? Step 2 of Your

Money or Your Life

involves calculating your real hourly wage, which is a very powerful

exercise for folks who thought the $50 per hour they're supposedly

making really ends up in their pockets.

Did you know that your job

may be costing you money? Step 2 of Your

Money or Your Life

involves calculating your real hourly wage, which is a very powerful

exercise for folks who thought the $50 per hour they're supposedly

making really ends up in their pockets.

To follow along at home,

first make some notes on how long you really spend

working. Start with those 40 hours in your cubicle, of course,

but then add in the hour you spend grooming, your daily commute, and

the extra hour you vegetate in front of the tube to wind down after

work. Do you have to study or take classes to stay up to date in

your field? Do you end up spending a week in bed because you're

so run down from work that you catch the flu? Add it all up!

Next, add up all of your

work-related expenses. These include the

gas and upkeep on your car, those fancy duds you wear to the office,

every meal or $5 cup of coffee you consume away from home because

you're too busy to pack a lunch, the six pack of beer you drink while

winding down in front of the tube, the massages you pay for to wipe out

the work stress, and the money you give other people to do your

household chores since you don't have time (daycare, house cleaning,

lawn upkeep, etc.) Don't forget to include your taxes.

Finally, use the formula

below to figure our your real hourly wage.

Total hours you really work in a week

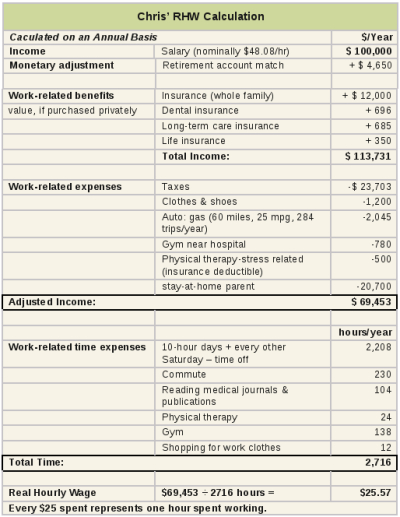

The example at the top

of the post from the Financial

Integrity website

shows how someone who thought she was making $48 per hour was

really making $25.57. The book includes someone who thought he

was making $11 per hour who was actually making $4. Without too

much of a stretch of the imagination, I can see how working could send

some job slaves into debt!

Luckily, I've very

rarely had a real job, but when I did I could

clearly see that the extra job-related time and money was a trap.

If you're working a real job, I encourage you to add it all up and

figure out your true hourly wage. Would you have accepted that

job if you'd realized you were only making $7 per hour?

| This post is part of our Your Money or Your Life lunchtime series.

Read all of the entries: |

Want more in-depth information? Browse through our books.

Or explore more posts by date or by subject.

About us: Anna Hess and Mark Hamilton spent over a decade living self-sufficiently in the mountains of Virginia before moving north to start over from scratch in the foothills of Ohio. They've experimented with permaculture, no-till gardening, trailersteading, home-based microbusinesses and much more, writing about their adventures in both blogs and books.

Want to be notified when new comments are posted on this page? Click on the RSS button after you add a comment to subscribe to the comment feed, or simply check the box beside "email replies to me" while writing your comment.

Don't sound like a good combination to me. Investing is an unsure business and brings its own worries. For me I'm pretty sure that the gains from investing money would not weigh up to the worries over my investments.

Besides, if we all become investors, who are we going to invest in?

Part of the program is just common sense; do not buy what you cannot pay for. Part of it sounds vaguely new-ageish like 'life energy', and it seems to gloss over the fact that some of us actually like a large part of our work, so that it gives us 'energy'.

Roland --- I assume you went to the website or book and saw that one of their final steps is saving up enough that you can invest it and live off the investment income, right? I'm with you --- that part doesn't seem quite as safe long-term as it could be (even though they recommend investing in bonds.)

I think that for people like you and me, "don't buy what you can't pay for" seems like common sense. On the other hand, it clearly isn't or Americans wouldn't be sinking further and further into debt. As a nation, we've had a negative percent savings over the last few years.

In reply to "some of us actually like a large part of our work", I'm of two minds. My last job was the best job I'd ever imagined. I was working for a non-profit, trying to help save the world, with people who were fascinating and like-minded. But after working there for two years, I wished I'd never taken the job and had just remained a volunteer! I ended up having to devote so much of my time to fundraising (which I came to hate) and other administrative tasks that I wasn't doing the parts of the job I loved any more, and my relationships with the board changed as I became staff instead of a volunteer. By the time I quit, I was thrilled to be out of the group. Granted, my experience can't be extrapolated out to everyone's work experience, but I think that most people wouldn't go in to work every day if it wasn't for the money. For those people, it makes lots of sense to shift gears so that you can volunteer doing the parts of your work you love and not get it all mixed up in making money.

Maybe as staff you were getting the shitty tasks because nobody was volunteering for them?

At the danger of using a terrible cliché, everything has its ups and its downs. As long as the ups outweigh the downs, you're good.

For myself, I tend to keep in mind the old saying "that which cannot be changed must be endured". So I just do the things that I consider chores but I try to avoid spending time grumbling about them. Makes life a lot easier.

Isn't debt to a large degree a question of how people raise their children? My father grew up during the depression and the Nazi occupation of WWII. As a result, he was very frugal. He never threw away anything that he thought he could use. Clothes were only disposed of if they were really worn, and then usually cut up into cloths for cleaning duty. Never borrowed money, because you'd be paying back the original amount several times over.

We grew up with that attitude, and a good thing too, IMO.

Of course it's partly a cultural thing as well. If loans are easy to come by, it's easy to slip into debt. Especially of there is no shame associated with being in debt. In the Netherlands the term 'in debt' (with the exception of a mortgage on a house, because house ownership is stimulated) carries a very strong negative association. And lenders have to check with a neutral credit registration agency before lending people money. They will usually not lend you money if you already have a large outstanding debt relative to your income.