How to retire early

Joe Dominguez, one of the authors of Your

Money or Your Life,

retired at age 31 using the formula he outlines in the book.

After figuring out the true value of his time and minimizing his

spending, he invested his savings in long term U.S. treasury bonds and

lived off the proceeds. Unfortunately, I don't know that his

success is replicable any longer --- treasury bonds are currently only

paying half of what they paid at that time, and I haven't stumbled

across any other types of investments that are as safe and stable while

paying such a high rate of return. I feel like it would take a

very determined person to save up a quarter to a half a million dollars

of investment capital and then manage to disentangle their souls from

the rat race.

Joe Dominguez, one of the authors of Your

Money or Your Life,

retired at age 31 using the formula he outlines in the book.

After figuring out the true value of his time and minimizing his

spending, he invested his savings in long term U.S. treasury bonds and

lived off the proceeds. Unfortunately, I don't know that his

success is replicable any longer --- treasury bonds are currently only

paying half of what they paid at that time, and I haven't stumbled

across any other types of investments that are as safe and stable while

paying such a high rate of return. I feel like it would take a

very determined person to save up a quarter to a half a million dollars

of investment capital and then manage to disentangle their souls from

the rat race.

While discussing the

book's anticlimactic ending with Mark, he pointed

out that we've really reached the same point using our chicken waterer

microbusiness. With just a few hours of work per week, we make

enough money to pay all of our bills and get to spend the rest of our

time pursuing our dreams. Basically, we're retired.

If you're still working

a full time job and dreaming that some day you

can retire and live your dream, now's the time to rethink your

priorities. You only live once, so you might as well enjoy your

hours here on earth! Here are a few more resources to speed you

on your way:

- Your Money or Your Life

by Joe Dominguez and Vicki Robin --- a bit out of date now, twenty

years after being published, but most of the book is still right on

track. (There's also a new edition that might be a bit more

up-to-date.)

- Financial Integrity website --- the up-to-date and free version of the above.

- The Ultimate Cheapskate's Roadmap to True Riches by Jeff Yeager --- if you need some more help learning to save money, this book should be on your reading list.

- The Four-Hour Work Week by Timothy Ferriss --- this is the book that jump-started us on our own quest to leaving the rat race.

- Microbusiness Independence by Anna Hess and Mark Hamilton --- This is our own personal story of how we created a small business that pays all of our bills in just a few hours a week, along with lots of tips to replicate our success.

| This post is part of our Your Money or Your Life lunchtime series.

Read all of the entries: |

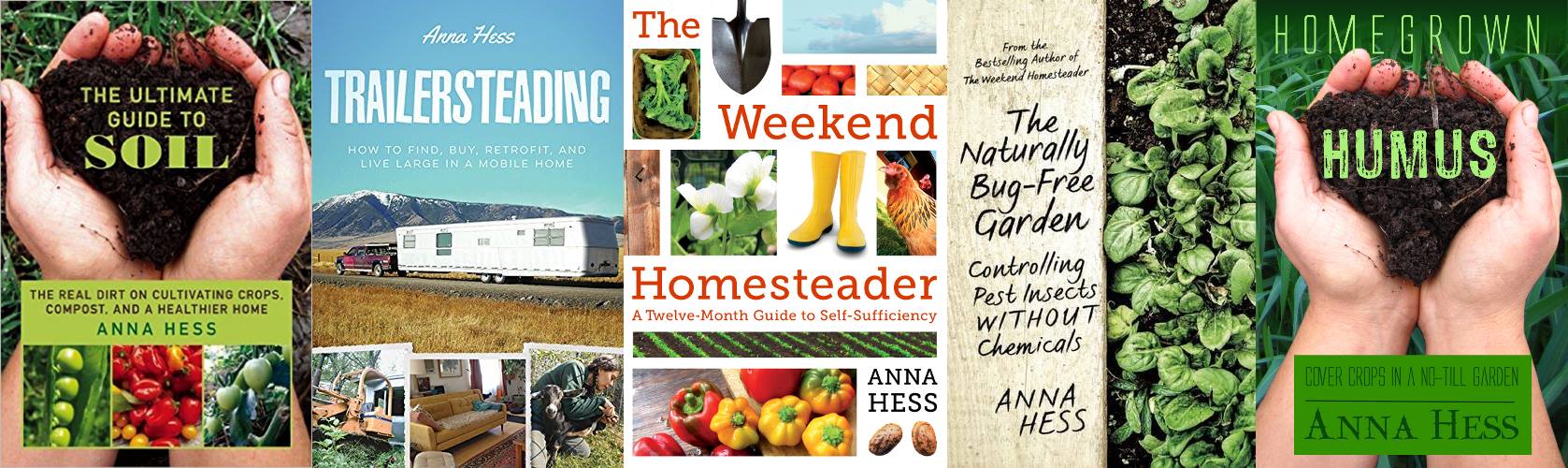

Want more in-depth information? Browse through our books.

Or explore more posts by date or by subject.

About us: Anna Hess and Mark Hamilton spent over a decade living self-sufficiently in the mountains of Virginia before moving north to start over from scratch in the foothills of Ohio. They've experimented with permaculture, no-till gardening, trailersteading, home-based microbusinesses and much more, writing about their adventures in both blogs and books.

Want to be notified when new comments are posted on this page? Click on the RSS button after you add a comment to subscribe to the comment feed, or simply check the box beside "email replies to me" while writing your comment.

Some issues with living your life off of savings. 1. We just saw what happens to invested money when the economy goes south. A lot of people who thought they had enough to retire are lining up to become greeters at Walmart. 2. What happens if the currency experiences hyperinflation? In places where this happened, a million lira wouldn't buy a stale loaf of bread. 3. What happens if currency and the economy hold but the majority become unable to earn a living? We're all in the same boat and shouldn't forget it.

4. Money's worth depends on common acceptance of its worth. It has no intrinsic value. Better, I think, to save something which does have intrinsic value which will not likely reduce. You're on the right track providing an indispensable product or service. Some possible good investments might be oil, metals...

Daddy --- all very good points! I'd add to two things to your list:

Learn not to need much. Then a rise in price won't matter.

Invest in becoming more self sufficient. We're slowly building our farm infrastructure so that it's easier and easier to keep the farm running. The founder of the forest gardening concept was, in a way, building for his old age --- he made more and more of his garden perennial edibles that required less and less work, so that when he was old, he was still easily able to grow his own food. Getting off the grid might be another example.

Roland --- so perfectly stated and so true!

Is it even possible for people to be self sufficient in today's world? I'd say not, unless you're willing and able to live as a hunter/gatherer and make your own clothes and tools and everthing. Call me a wuss, but self-sufficiency in that sense is overrated, IMO. Most people do not appreciate the amount of effort that goes into developing and producing all the everyday things that we take for granted.

Most people do not appreciate the amount of effort that goes into developing and producing all the everyday things that we take for granted.

And hunter/gatherers seem to agree. Just look into history. Hunter/gatherers like the native americans gladly replaced their stone tomahawk heads with steel ones, and bows with firearms, even it they could not make those themselves.

Of course it's not possible to be entirely self-sufficient in today's society (without going to extremes that even I wouldn't be happy with.) But you can go a long way toward self sufficiency with simple steps like growing your own food, learning to do your own day to day chores, growing your own trees for firewood, etc. Sure, if the modern world collapsed, we'd quickly find out that it's difficult to live without being able to buy a new belt for our car, but barring that sort of collapse, each year finds us a bit more self-sufficient and spending less money.

My favorite example is electricity. We've been on the farm for three and a half years, and each year our electric company raises our rates considerably (18% last year, 16% this winter.) But each year we've also been putting energy-saving measures into effect, so our bill has actually stayed steady or gone down while everyone else's goes up. That's what I consider investing in self-sufficiency.